10F, Building B, Erqi Center, Erqi District,

Zhengzhou City,

Henan Province, China

Wit:+86 15138685087

(WhatsApp/Wechat)

10F, Building B, Erqi Center, Erqi District,

Zhengzhou City,

Henan Province, China

Wit:+86 15138685087

(WhatsApp/Wechat)

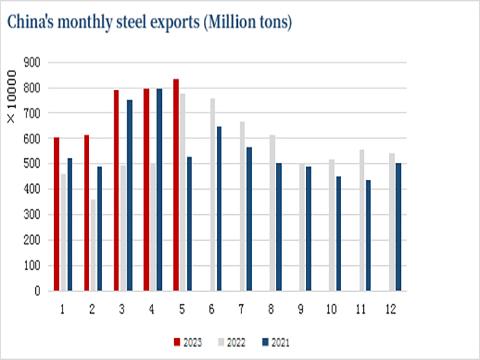

In May 2023, China exported 8.356 million tons of steel, an increase of 5.3% month-on-month. This exceeded the 7.76 million tons of exports in the same period last year due to the conflict between Russia and Ukraine and hit a new monthly high since September 2016. Cumulative exports from January to May increased 40.9% from the same period last year to 36.369 million tons.

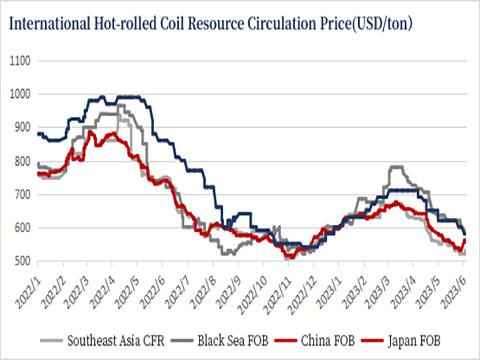

International Hot-rolled Coil Circulation Price Chart

China’s Monthly Steel Exports

In March, the overall trend of global steel prices showed a rise and fall. In early March, international raw material prices were running at a high level, and with the support of multiple favorable manufacturing policies in the European and American markets, finished steel prices continued to rise in February. US hot rolled steel coil prices returned to $1,200 / ton, the highest since June last year. European car industry data were also strong, adding to confidence.

With the release of interest rate hike signals by the Federal Reserve in mid-March, commodity prices and steel demand have formed a certain inhibition, and the confidence of manufacturing enterprises has significantly weakened. The actual order performance of the manufacturing industry in Europe also appears to be insufficient, and market prices are gradually showing a trend of rising and falling. However, by then, the factory prices announced by almost all leading steel mills in Europe, North America, and Asia continued to rise, stabilizing the market mentality to a certain extent. Part of the reason is that overall supply is still tight, and the restart of equipment in the European market in February and March has not yet restored the previous productivity. Overall, the European and U.S. markets were low in inventory in March and remained largely bullish.

European steel supplies fell in March. The problem with the converter plant of Xavier Steel is that the output decreased in March, MMK is still in the maintenance state, and NLMK is not active in the export market quotation. This has reduced the flow of Russian resources to Asia and the Middle East, helping to boost local prices.

In May, China’s thermal plate exports maintained a high level, but compared with April, the increase may not be obvious or decreased. However, cold rolled steel coil, galvanized, galvalume, and other cold-series plate exports are considerable, including exports to Southeast Asian markets. In addition, wire exports have also increased.

Although the Turkish side in the two times delayed import tariffs on the plate, in May this year, the formal imposition of tariffs, the market for this expectation has been digested, and the price of local domestic and foreign trade prices is not having a very big impact. China’s hot coil and cold series plate exports to Turkey in May, June, and July are relatively smooth. Local production costs are currently high, and Turkish steel mills are still actively increasing in the context of the overall downward trend in global prices.

Since March, China’s hot-rolled coil resources have obtained a higher sales price in Africa, according to the feedback of steel mills, the same type of hot coil resources in Africa in May orders may be higher than in Southeast Asia 10-15 US dollars/ton.

| China Steel FOB Price (Unit: USD/ton) | ||||||

| Name | Material | Specification | Price | Ups and Downs | Port | Date |

| Bar | B500B | 20mm | 580 | -2 | Zhangjiagang | June 13th |

| Medium-thick plate | SS400 | 6-8mm | 599 | -5 | Bayuquan Area | June 13th |

| Hot Rolled Coil | SS400 | 14-20mm | 568 | 0 | Tianjin | June 13th |

| Cold rolled coil | SPCC | 1.0*1250*C | 631 | 0 | Tianjin | June 13th |

| Galvanized | DX51D+Z | 1.0*1250*C | 704 | 0 | Tianjin | June 13th |

| H-steel | SS400 | 200*200 | 535 | 0 | Bayuquan Area | June 13th |

According to the known order level, after entering the June shipping period, China’s export orders have slowed down significantly, and buyers have a strong wait-and-see mentality. On the one hand, the export order is better in May, and the steel mill can sell not many orders. On the other hand, due to the continuous negative market decline in April, the buying is more cautious. Because of the high cost of raw materials at that time, the willingness of steel mills to sharply reduce prices for exports weakened. But cold products are still good compared to hot ones.

Export orders are likely to recover in July and August as raw material prices ease. At the end of May, China’s hot coil export orders increased in a number of markets under the price advantage. Including Southeast Asia, the Middle East, and South America markets.

After the rise in China’s export prices, overseas buyers have followed up to a reasonable extent, and some Chinese steel mills have entered the August shipping schedule. The FOB price of SS400 hot rolled steel coils increased from $510-515 / ton FOB two weeks ago to $540-550 / ton FOB this week.

In general, China’s exports to the Middle East, Africa, South America, and other places may have increased in May, but most likely slowed down in June. From the current order level. The significant increase in orders for cold series products in July and August, or the monthly steel exports can still be maintained at more than 7.5 million tons.